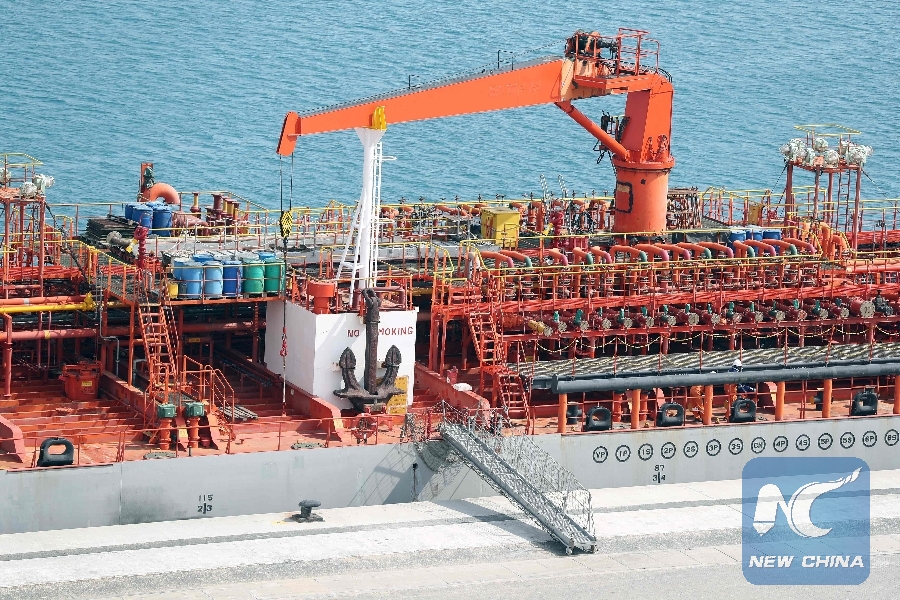

File photo shows the Ras Laffan Industrial City, Qatar's principal site for production of liquefied natural gas and gas-to-liquid, administrated by Qatar Petroleum, some 80 kilometers north of the capital Doha, on Feb. 6, 2017. (Xinhua/AFP)

by Xinhua writers Ma Qian, Wang Naishui, Liu Yanan

NEW YORK, Dec. 3 (Xinhua) -- Qatar's announcement Monday to withdraw from the Organization of the Petroleum Exporting Countries (OPEC) sparked investors' concerns over a more volatile policy-making in the global oil market, amid persistent fears of oversupply and shrinking demand shown in constant price slides over the last two months.

"The high volatility and large down move of the last 60 days will have a lasting impact on trading going into first quarter of 2019," said Albert Helmig, CEO of Grey House, a private consulting firm focused on market structure, risk management and price models.

CONCERNS BUILD UP

Qatar's decision to end its 57-year membership in the oil cartel on Jan. 1, 2019 came three days ahead of a meeting between the Saudi-led OPEC and its allies to reshape global oil policy to grapple with broad price drops.

Qatar's Minister of Energy Saad al-Kaabi told press that Doha would still attend OPEC's upcoming meeting on Thursday and Friday in Vienna.

"We are not saying we are going to get out of the oil business, but it is controlled by an organization managed by a country," said al-Kaabi.

Al-Kaabi added that it would not be practical for Doha to "put effort and resources and time in an organization" in which Qatar was "a very small player, and didn't have a real say in what happens."

The decision "does come at a time when OPEC needs to hammer out a deal in the face of market skepticism in the cartel's ability to control production," said Ann-Louise Hittle, head of Macro Oils at Wood Mackenzie, an Edinburgh-based global energy research and consultancy firm, in a press release.

Hittle also pointed out that as the smaller nations of OPEC have a relatively passive role in the group's decision-making, "Qatar may also see that it has less to gain from its membership."

The move exposed the deepening rift between Qatar and its Gulf neighbors since June 2017, when Saudi Arabia, the United Arab Emirates and others severed diplomatic ties with Qatar.

Doha's quitting OPEC consequently gave rise to concerns that Saudi Arabia, Russia and the United States, the world's top three oil producers, would gain more control over global oil policy-making, as geopolitics has been one of the main drivers behind oil prices.

Russia has recently shown its willingness to cooperate with OPEC in a potential oil output cut in the face of U.S. calls for a further pullback in oil prices.

Investors had worried that Saudi Arabia would avoid confronting the United States over oil prices.

"Prior OPEC-Russian efforts to cut production were effective for as long as a year, but ultimately the result is loss of market share to the United States and a return to low prices," said Chris Low, chief economist at U.S. securities broker firm FTN Financial, in a note to media.

Helmig said that despite investors' anticipation of an OPEC announcement of a production cut, the market has been very cautious and "awaiting more details of size and timing of a production change."

BIGGEST LNG PRODUCER

Analysts said Qatar's decision would not have a significant impact on oil prices as its production accounts for only 2 percent of OPEC's total output. Yet the smallest Middle East oil producer in OPEC is currently the world's biggest liquefied natural gas (LNG) exporter.

Al-Kaabi said his country plans to increase LNG output to 110 million tons per year by 2024, calling Doha's withdrawal decision part of a long-term strategy.

Energy market watchers believed that Doha's latest move indicated that the small Gulf nation is seeking dominance in the global LNG market.

"Qatar's OPEC exit underlines the country's aim to maintain its place in the global LNG market," said Lynn Morris-Akinyemi, a research analyst at Wood Mackenzie.

Helmig also said the decision made sense given the volatile nature of global geo-politics. "Within the complex geo-politics inside OPEC and the focus on oil, the Qatari position is not a surprise. Their stated position is to focus on expanding their LNG portfolio."